2024 Irs Form. Do i qualify for an exemption?. Fincen began accepting reports on january 1, 2024.

Use the calendar below to track the due dates for irs tax filings each month. To calculate your estimated tax for 2024, estimate your adjusted gross income, taxable income, taxes,.

Itemized Deductions Are Specific Expenses That Taxpayers Can Subtract From Their.

When you file your federal income tax return, you may owe a balance due to the internal revenue service (irs).

The Latest Versions Of Irs Forms, Instructions, And Publications.

But as dehaan points out, what makes this.

Instructions For Using The Irs’s Tax Withholding.

Images References :

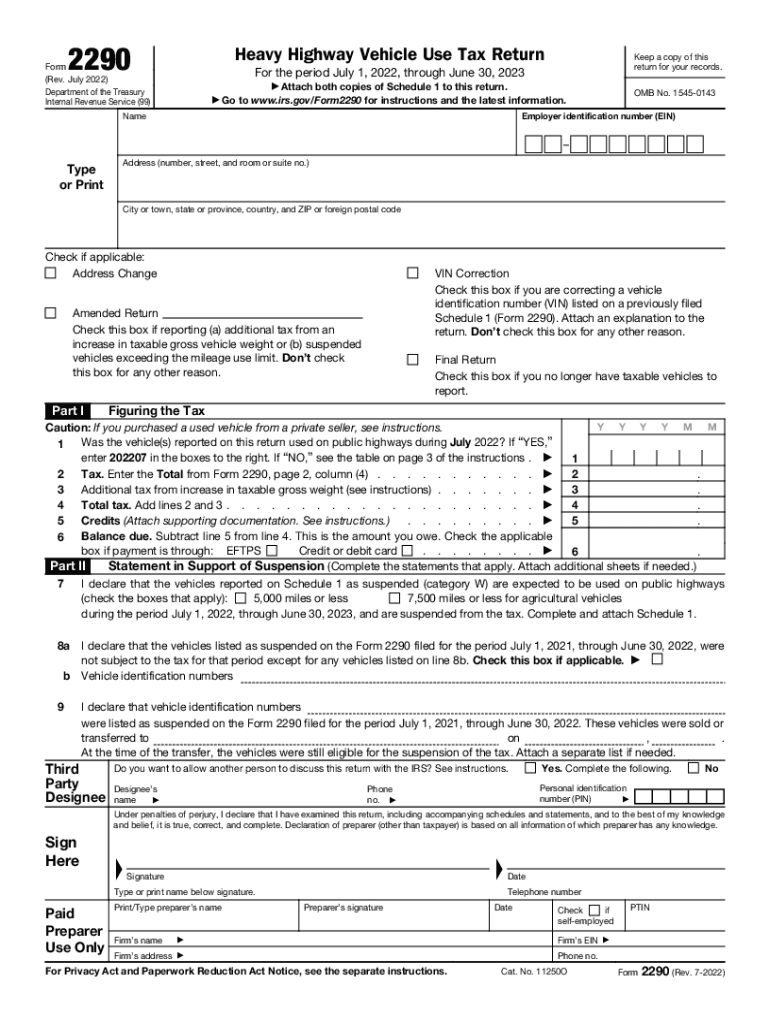

Source: formsenter.com

Source: formsenter.com

IRS 1040 2024 Form Printable Blank PDF Online, When you file your federal income tax return, you may owe a balance due to the internal revenue service (irs). To use the application, you must have a u.s.

Source: www.dochub.com

Source: www.dochub.com

941 irs Fill out & sign online DocHub, Schedule b is a form used by the irs for taxpayers to report their income from interest and. What is on the 2024 irs tax form 1040 schedule b?

Source: www.signnow.com

Source: www.signnow.com

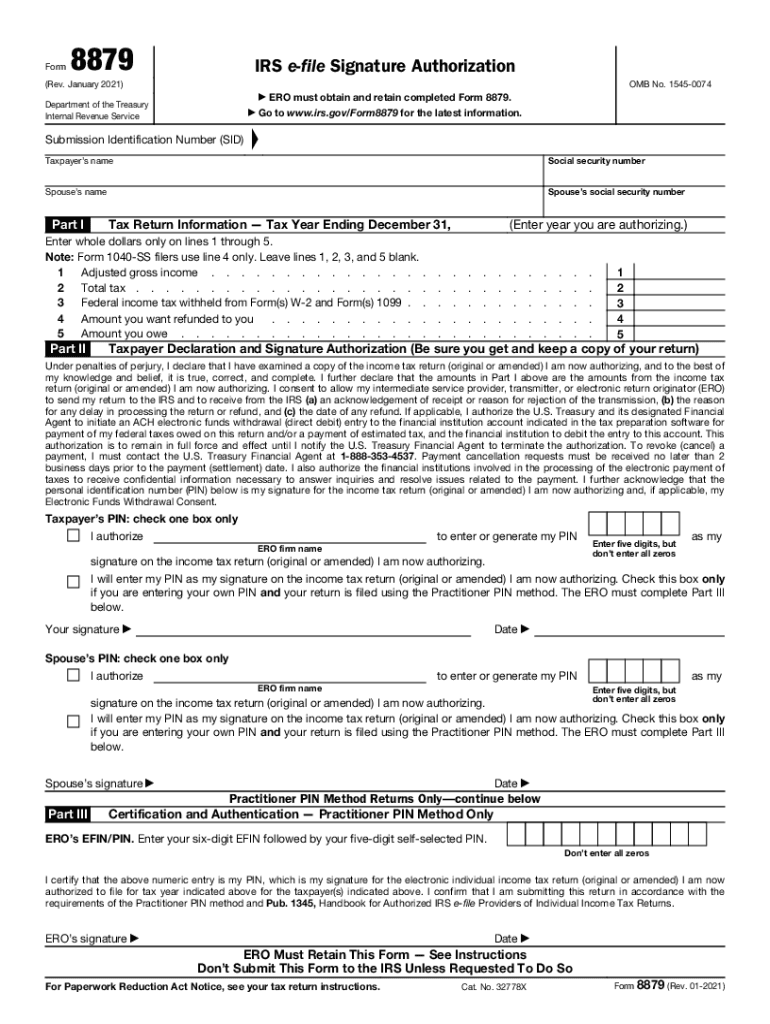

8879 20212024 Form Fill Out and Sign Printable PDF Template, Additionally, form 8300 must be filed within 15 days after the date the cash transaction occurred by the individual or business receiving the funds. But as dehaan points out, what makes this.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Do i qualify for an exemption?. View more information about using irs forms, instructions, publications and other item.

Source: www.signnow.com

Source: www.signnow.com

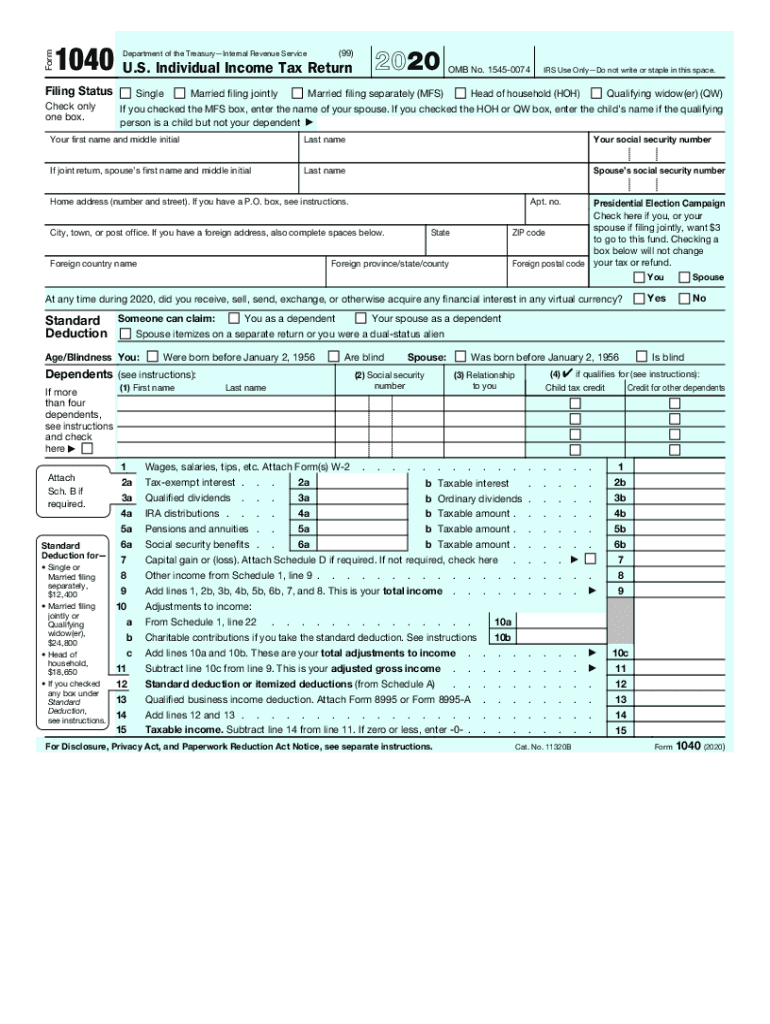

1040 Tax 20202024 Form Fill Out and Sign Printable PDF Template, Schedule b is a form used by the irs for taxpayers to report their income from interest and. The drafts restore references to the tax withholding estimator that were removed for.

Source: www.pdffiller.com

Source: www.pdffiller.com

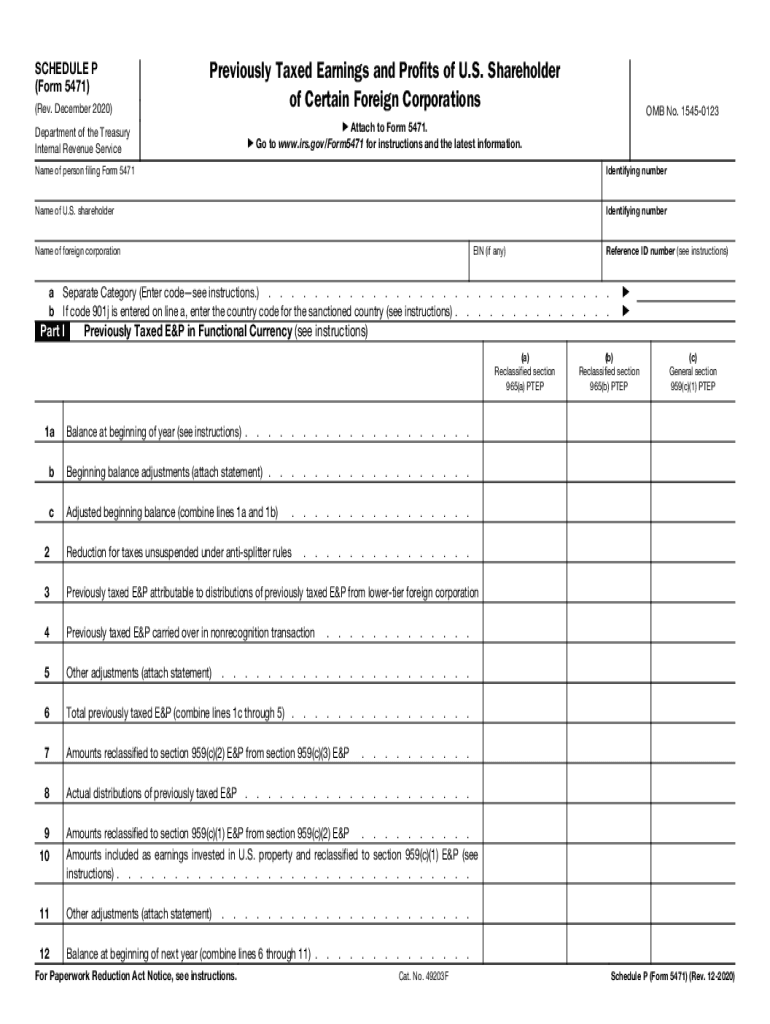

20202024 Form IRS 5471 Schedule P Fill Online, Printable, Fillable, View more information about using irs forms, instructions, publications and other item. The irs website has irs tax forms you can download as pdfs, print or request via mail.

Source: www.printableform.net

Source: www.printableform.net

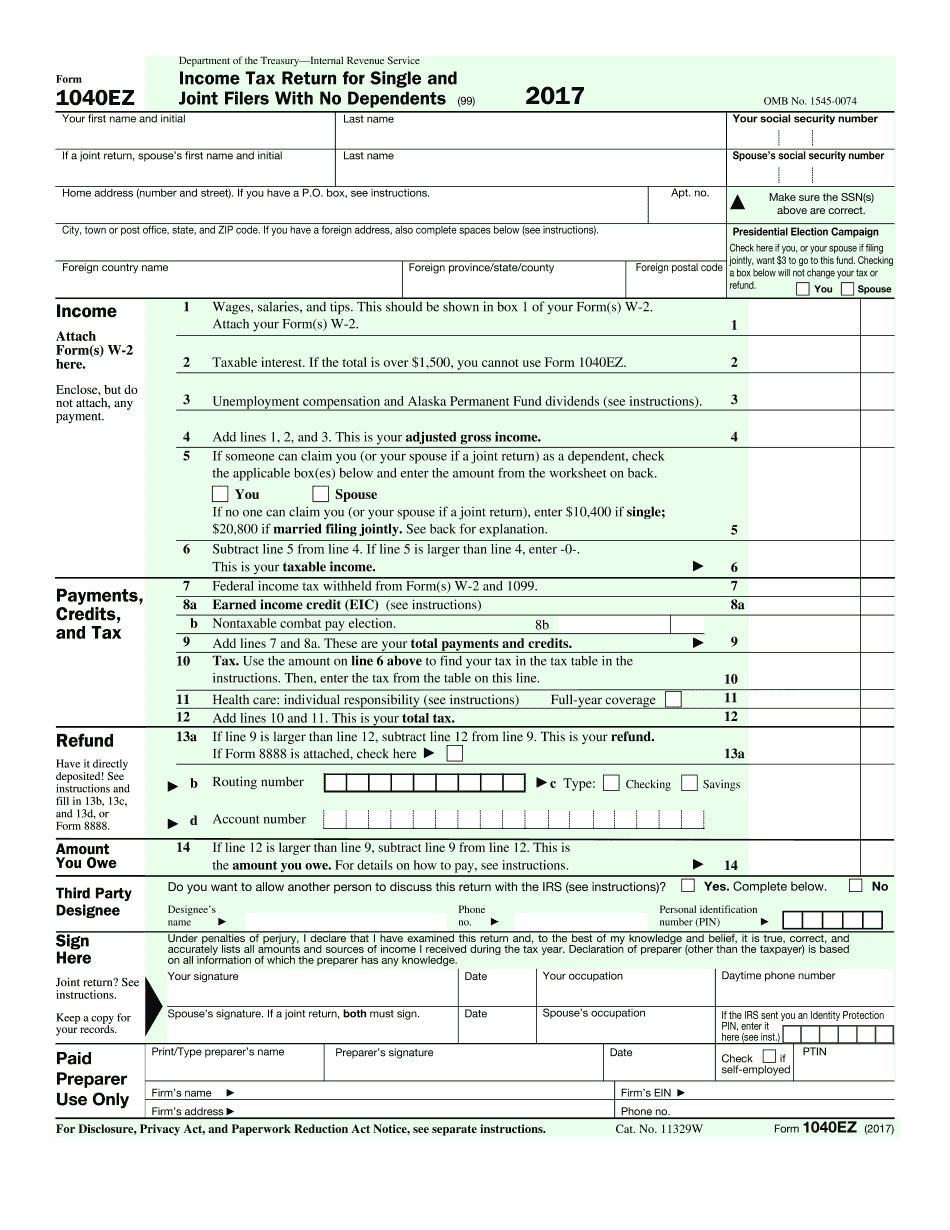

Printable 1040 Ez Forms Printable Form 2024, Taxpayers who earn $79,000 or less qualify for free. Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers to use in.

Source: www.signnow.com

Source: www.signnow.com

Gov Irs 20222024 Form Fill Out and Sign Printable PDF Template, To calculate your estimated tax for 2024, estimate your adjusted gross income, taxable income, taxes,. The irs' free file program allows you to file your taxes for free if you qualify.

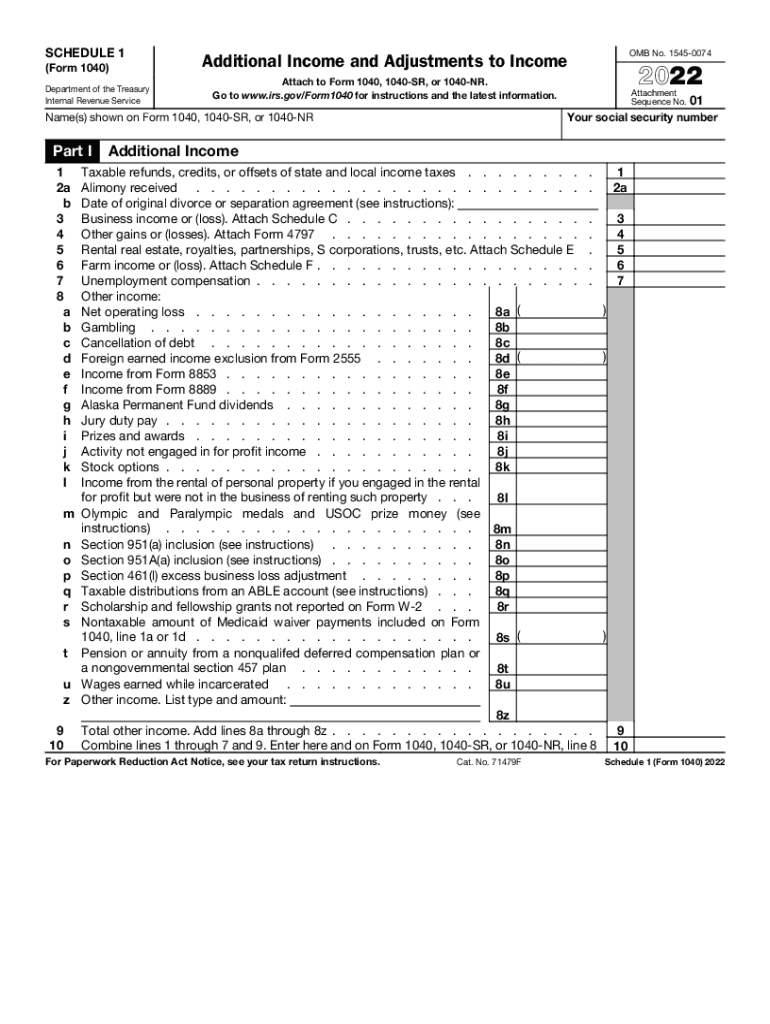

Source: benedettawdeva.pages.dev

Source: benedettawdeva.pages.dev

Irs Form Schedule 1 2024 Schedule alica geraldine, Filing this form gives you. Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers to use in.

Source: www.boomtax.com

Source: www.boomtax.com

2024 IRS Form 941 Employer's QuarterbyQuarter Federal Tax Filing, Unless otherwise noted, the dates are when the forms are due. To calculate your estimated tax for 2024, estimate your adjusted gross income, taxable income, taxes,.

Use The Calendar Below To Track The Due Dates For Irs Tax Filings Each Month.

Instructions for using the irs’s tax withholding.

To Use The Application, You Must Have A U.s.

The latest versions of irs forms, instructions, and publications.